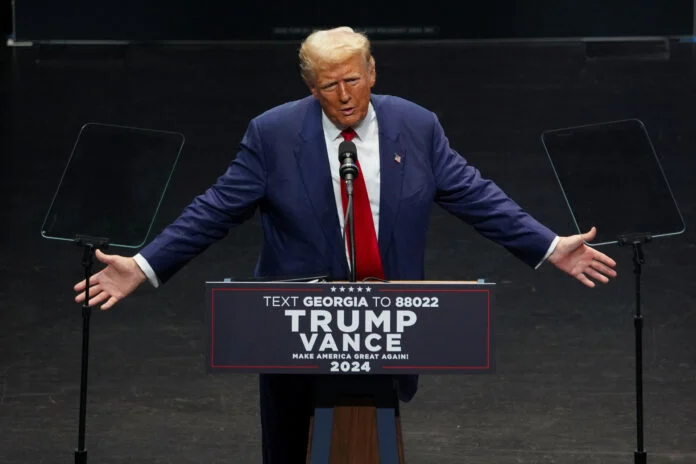

Η απελευθέρωση του meme coin, $Trump, έρχεται καθώς ετοιμάζεται να αναλάβει τα καθήκοντά του τη Δευτέρα ως 47ος πρόεδρος των...

Ο Κωστής Σαββιδάκης είναι ηθοποιός με καταγωγή από τη Ρόδο, ο οποίος έχει συμμετάσχει σε αρκετές τηλεοπτικές σειρές και θεατρικά...

To Geopolitico.gr χορηγός Επικοινωνίας στο Intelligence & Security Forum, το οποίο συγκεντρώνει κορυφαίους αναλυτές. Κλείστε θέση Μεταξύ των διακεκριμένων ομιλητών περιλαμβάνονται: • John Kiriakou: Πρώην αξιωματικός...

Berkeley Earth, a non-profit climate change organization, concluded that climate chaos was at its worst in the last decade. Its Global Temperature Report for 2024 said that “2024...

Χαίρετε,θα ήθελα να καταθέσω κάποιες σκέψεις για την αντιμετώπιση του παντουρκισμού-παντουρανισμού.Σε περίπτωση που γίνει αυτή η ένωση ακόμα και εδαφικά πράγμα που φαίνεται πολύ δύσκολο γιατί...

Ο Μελ Γκίμπσον μίλησε για τον πόλεμο που δέχτηκε από το σύστημα για τα «Πάθη του Χριστού» - «Τα ευαγγέλια είναι ιστορία που επαληθεύεται»